Take control

of your finances.

By understanding where your money goes, you can make informed choices to save, invest, and ultimately achieve financial freedom.

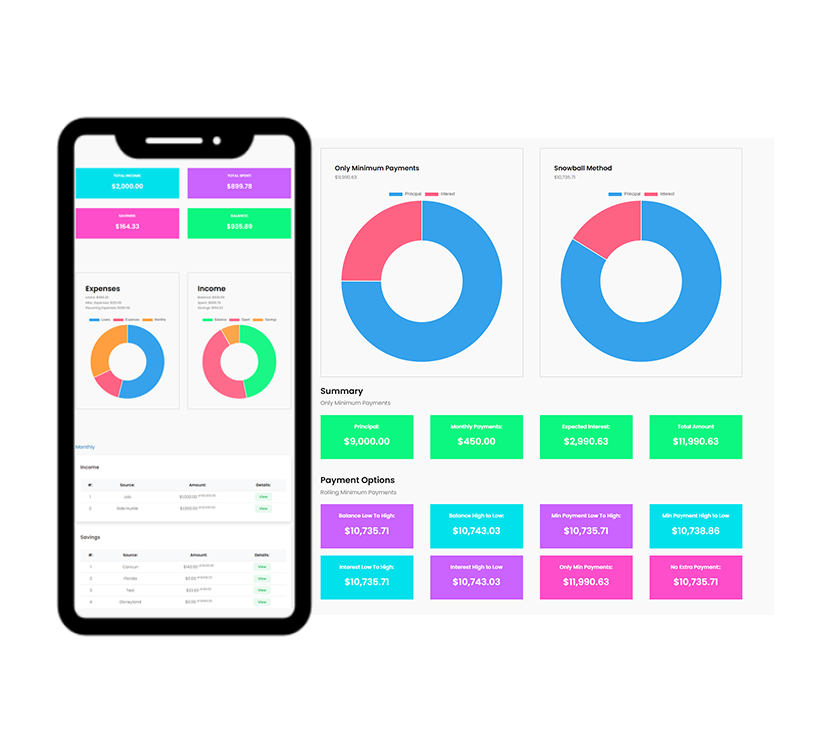

MyBudgetPro simple yet powerful.

Take control of your finances with our easy-to-use budgeting program!

Get Started

Getting Started

These basic steps will help you understand your financial options.

What does financial freedom look like for you? Is it early retirement, traveling the world, or simply living comfortably without financial stress? Having a clear vision will guide your entire approach.

Based on your income and spending habits, create a budget that allocates funds for necessities, savings, and some fun (but budgeted) spending. Prioritize needs like housing and food, then factor in debt payments and savings goals.

Understanding your debt and the different options for paying it off will help you make educated decisions. High-interest debt like credit cards can cripple your progress. Focus on paying them off quickly. Consider debt consolidation or a snowball method.

Aim for 3-6 months of living expenses saved in a high-yield savings account. This safety net protects you from unexpected costs and prevents dipping into long-term savings.

Once the debt is under control and you have an emergency fund, explore investing. Research low-cost index funds or seek a financial advisor's guidance. Remember, investing is for the long term, so focus on consistent growth, not get-rich-quick schemes.